Distance Converter

In today’s digital world, businesses are constantly searching for innovative solutions to streamline their accounting processes. With the rise of cloud technology, traditional accounting software is quickly being replaced by cloud-based alternatives. These platforms offer flexibility, scalability, and accessibility, making them a game-changer for businesses of all sizes. In this blog, acameramen.com will help you explore the some options of cloud-based accounting software and how it can revolutionize your financial management. So, let’s dive in and discover why cloud-based accounting software is the future of modern businesses.

1. Freshbooks – Cloud-Based Accounting Software

FreshBooks is an intuitive, easy-to-use accounting tool for small business owners without an accounting experience. It simplifies the process for users to manage projects, create invoices, monitor time and expenses, track loans, and file taxes. It is a cloud-based platform, thus any device may access it.

FreshBooks started off as an invoice-generating and tracking project to help small businesses and solopreneurs get paid more rapidly. Accounting software continues to focus largely on helping business owners get timely and accurate payments even 20 years after it was established. With the use of services like recurring invoicing, automatic payment reminders, and online payments, customers can conveniently make their payments anyway they like.

FreshBooks has four different pricing tiers, with the Lite plan starting at $17 a month ($6.80 with the current price). With this subscription, customers may send an unlimited number of invoices to a maximum of five clients, keep track of an unlimited number of costs, send an unlimited number of estimates, monitor sales tax, and take credit card payments. With each successive plan, more capabilities are unlocked, including double-entry reports on accounting, mobile mileage tracking, the ability to generate accounting and financial reports, the ability to manage invoices, bill payments, and vendors using accounts payable, the ability to monitor project profitability, and more.

2. Xero – Cloud-Based Accounting Software

Small businesses love the user-friendly, cloud-based accounting software called Xero. It is simple to use even for individuals without accounting knowledge thanks to its straightforward approach to recording revenue and spending. The ability to produce and send invoices, manage time and project profitability, claim costs, bulk reconcile transactions, and accept different currencies are among the top features of each plan.

The three Xero plans range in price from $13 to $70 per month, with the first three to six months being discounted by 50% as part of Zero’s current promotion. The Early plan is advised for sole proprietors. The platform’s most popular plan, Growing, is advised for expanding enterprises, and the Established plan is advised for established ones. Every subscription comes with an unlimited number of free users, which is quite beneficial for businesses with several team members or a sizable accounting department.

The Early plan’s restriction on customers to 20 quotations and invoices and just five bills per month is one of its biggest drawbacks. One that involves payroll is absent from all three designs. Companies must integrate with Gusto for $40 per month if they wish to connect payroll to their accounting software.

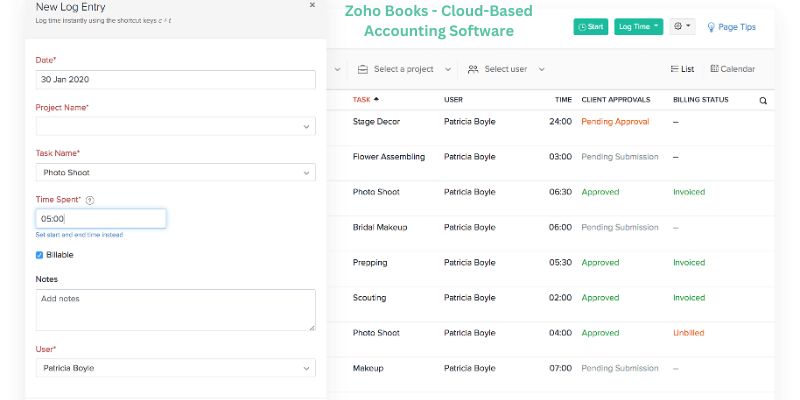

3. Zoho Books – Cloud-Based Accounting Software

Zoho Books is the name of the cloud-based accounting component of a larger collection of business solution offerings. In addition to accounting software, Zoho provides over 40 enterprise-level web applications for boosting sales, marketing your company, working with team members, providing customer service, and more. Organizations needing an integrated corporate environment will have a hard time finding a more comprehensive business suite.

Users of Zoho may create a variety of financial reports for their businesses, send out customized invoices, link to payment processors, control expenditure, and calculate taxes. One of its main features is the Accounting Client Portal. Users may swiftly gather bulk payments using the interface, solicit feedback, speed up estimate approval, and talk about recent transactions. The ability to manage staff and expenses at the project level is one of Zoho’s strong project management skills. Thanks to Zoho’s cloud-based design, users may download the WorkDrive Desktop application, sync files or folders straight to their device, and view and edit files when offline.

Zoho Books offers subscription-based services in six tiers. The premium plans’ recurring costs range from $15 to $249 per month. Zoho does offer a permanently free option, provided that the fiscal year’s income is less than $50,000. The plan is surprisingly feature-rich for a free one. Its features include handling up to 1,000 invoices yearly, taking both online and offline payments, providing clients with a client site, automating reminders for payments, managing 1099 contractors, and more. Additionally, it has one accountant and one user.

Conclusion

In conclusion, the way that organizations handle their financial operations has been transformed by the usage of cloud-based accounting software. Xero, Freshbooks, and Zoho Books stand out as trustworthy and effective options among the best options on the market. These systems include a wide range of functionality and features that simplify accounting chores, increase accuracy, and foster teamwork. Implementing cloud-based accounting software may provide you the accessibility, flexibility, and scalability required to manage your accounts, regardless of whether you run a small business or a huge corporation. With Xero, Freshbooks, and Zoho Books, you may advance your accounting procedures while concentrating on expanding your company.